The 3 Decisions That Lead CFOs to Carma

By: Joe McDermott, CFO/COO

At Carma, I talk to CFOs a lot, and I’m hearing the same stories:

You walk into a board meeting and you’re hit with, “how confident are we in that number?”

Odds are, you have data you don’t trust, and AI pressure is only highlighting the gaps. It’s not a position you want to be in.

When data isn’t precise, CFOs pay the credibility tax.

That tension is leading CFOs to say “enough.” I’m seeing CFOs who choose Carma all making the same three decisions. And it’s not really about software. It’s about revenue assurance and trusting their numbers.

Decision #1: Stop Accepting Results You Can’t Defend

There’s no shortage of data...it’s whether or not that data tells the full story (or even an accurate one).

For example: In our industry, revenue spans contracts, designs, service delivery, SLAs, all the way to billing. But those inputs rarely live in one place.

Revenue assurance becomes periodic, consisting of manual audits, disputes, and reconciliations—all under pressure.

The decision: Revenue assurance must be continuous and automated.

CFOs know the real risk isn’t just leakage, it’s walking into the boardroom unable to trace revenue end-to-end. And unable to identify the source of leaks, let alone implement strategies to reclaim it.

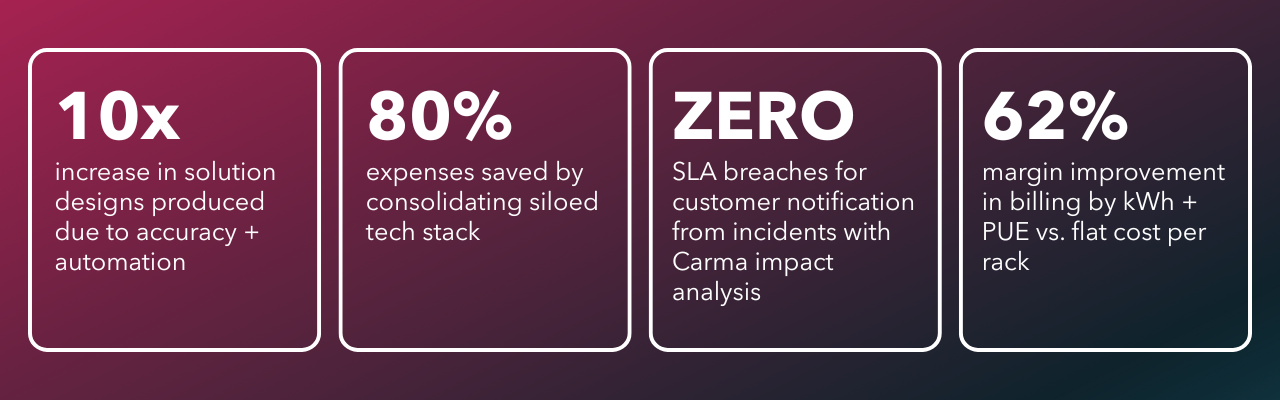

This is why we built Carma’s data model: to connect data from pre-sales through design, operations, and billing. With an intact paper trail, you can spot the leaks and prevent them altogether.

Decision #2: Connect Operational Data to Financial Outcomes

EBITDA is operationally driven. Power consumption and utilization, asset performance, and service delivery all shape margins long before they hit financial reports.

But too often, without unified data, margin management can be retrospective.

The decision: Finance needs precise visibility into operations and the impact to the bottom line.

CFOs make this decision when they realize they need to influence margins earlier. And with Carma, we give that visibility down to the minute of remote hands work, kilowatts of power consumed, and individual assets provisioned.

Decision #3: Focus on Data Before AI

The asks of CFOs right now are nothing new: move faster and spend less.

And with the AI race heating up, the pressure is on. But savvy CFOs are realizing that their disjointed data is the bottleneck to getting any use out of AI. And that data is really the foundation of whipping their systems into shape, reducing costs, and improving revenue.

The decision: Invest in data as it will enable AI and the financial outcomes the board is looking for.

CFOs know that governance is the prerequisite for speed. And they need a data model built for their business to achieve their targets.

It’s Not About New Tools, It’s About Outcomes

Our customers often come to us after failed software implementations. Because it’s not just about inventory management or getting quotes out fast—it’s about how the ecosystem works together.

Disparate data is a silent killer. And you feel it every time you walk into the boardroom.

The CFOs we work with are the ones who were fed up with that status quo. Are you one of them?

Author Bio: Joe McDermott

Joe is the COO/CFO and co-founder of Carma. He has extensive experience in startups, technology development, government R&D, and finance. At Carma, he leads product, operations, and finance, with a focus on delivering exceptional customer experience, value, and network safety. Joe holds an MBA from Harvard Business School, a PhD in Materials Science from Princeton, and a BS in Physics and Chemistry from Georgetown.